When you’re building a startup, every hire matters.

The right talent can accelerate growth, drive innovation, and set the foundation for long-term success. But without clear data to guide your hiring strategies, even the best recruiting efforts can fall short.

That’s where talent acquisition metrics come in. These are quantifiable indicators that help you assess efficiency, effectiveness, and overall impact of your hiring activities. From how fast you fill roles to how well you align your workforce with broader business goals.

Tracking the right talent acquisition metrics allows you to:

- Align hiring with business strategy

- Optimize recruiting costs and sourcing ROI

- Improve the candidate experience and employer brand

- Boost quality of hire and long-term retention

In this guide, we’ll walk you through the 7 best talent acquisition metrics every startup should track. These metrics will help you make smarter, faster, and more strategic hiring decisions as you scale.

What Are Talent Acquisition Metrics?

Talent acquisition metrics are quantifiable data points that assess the efficiency, effectiveness, and impact of an organization’s hiring activities.

While recruiting metrics often address short-term, tactical efforts (like filling a role), talent acquisition metrics align with long-term strategic objectives, such as workforce planning, diversity, retention, and ROI.

Why Talent Acquisition Matters

Here are 6 reasons why they matter and what you’re missing out on by not developing your hiring processes:

- Strategic Alignment – Ensure hiring supports broader business goals, such as growth, innovation, cost containment.

- Decision-Making – Pinpoint what works, identify bottlenecks, and back decisions with evidence.

- Candidate Experience – Reduce drop-off rates and improve engagement.

- Quality of Hire – Elevate performance and reduce attrition.

- Employer Brand – Strong metrics enhance perception in the talent market.

- Resource Optimization – Refine budget allocation and maximize sourcing ROI.

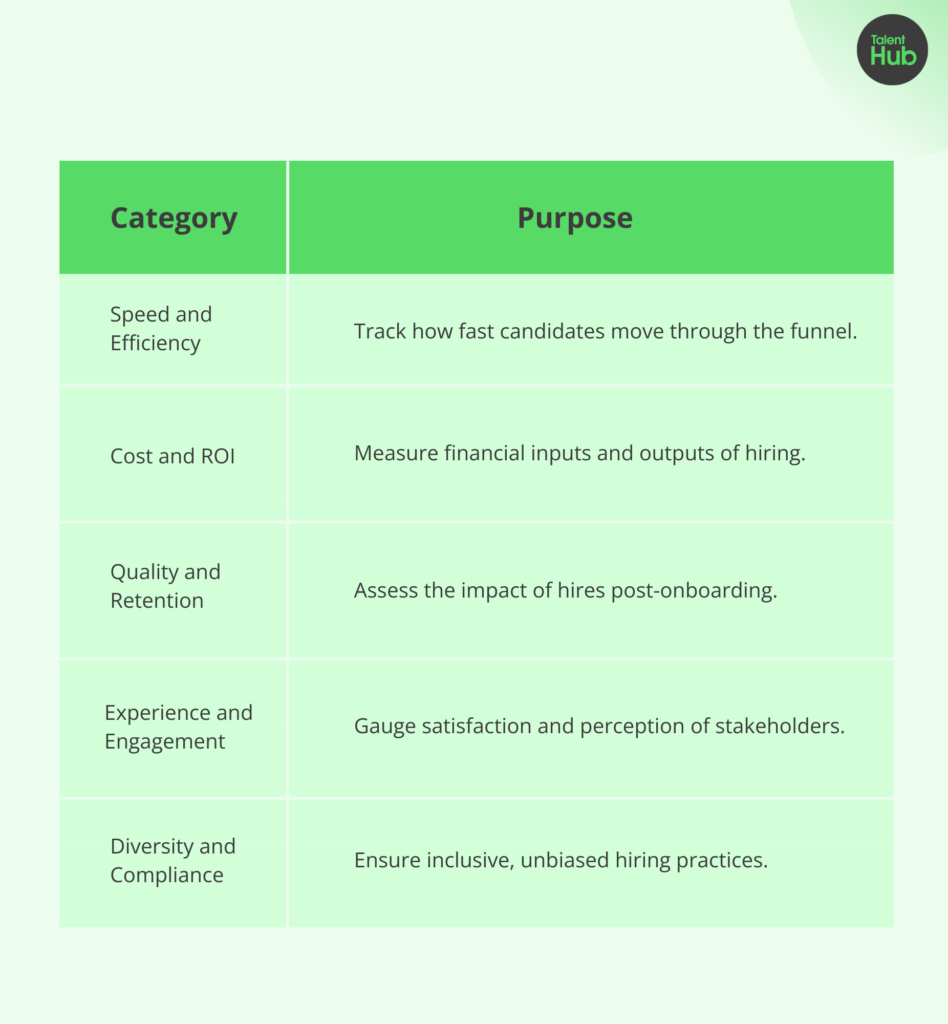

Talent acquisition metrics and best practices

What metrics should matter most to a talent acquisition team? The most important metrics for a talent acquisition team should be aligned to business goals — not just filling jobs fast, but filling them effectively and sustainably.

The 7 Most Strategic Talent Acquisition Metrics

Tracking talent acquisition metrics is about collecting data.

It also means focusing on the indicators that drive smarter hiring decisions, better candidate experiences, and stronger business outcomes.

Here are 7 best talent acquisition metrics for your startup:

1. Time to Fill

Time to fill measures how many calendar days it takes to close an open role, starting from when a job requisition is approved, or posted, to the candidate accepting the offer.

It captures the full length of your recruitment process, from internal approvals and job posting to candidate selection and offer acceptance. This metric is critical because it impacts workforce planning, operational efficiency, and costs.

The longer a role stays vacant, the more stress is placed on existing teams, the more productivity suffers, and the higher your indirect costs climb. Prolonged vacancies can also damage your candidate experience and employer brand, as top talent often drops out when hiring processes are slow.

The formula for time to fill:

Time to Fill = (Offer acceptance date – Requisition approval date)

To find the average time to fill across multiple roles:

Average Time to Fill = (Sum of all time to fill values) ÷ (Number of roles filled)

Benchmarking is important: Across industries, time to fill averages about 42-44 days, but it can vary based on role complexity and market conditions. Regularly tracking and optimizing this metric helps you reduce bottlenecks, increase hiring efficiency, and secure top talent faster.

2. Time to Hire

Time to hire measures the number of days between when a candidate enters your recruitment pipeline (through application, sourcing, or referral) and when they accept your job offer.

It focuses on how fast your hiring team moves qualified candidates through the process — from initial contact to signed offer. This crucial metric impacts your ability to secure top talent.

A long time to hire risks losing strong applicants to competitors with faster, more efficient processes. It also influences the candidate experience, as delays:

- Create frustration

- Lower engagement

- Weaken your employer brand

The formula for time to hire:

Time to Hire = (Offer acceptance date – Date candidate entered the pipeline)

To find the average time to hire across multiple hires:

Average Time to Hire = (Sum of all time to hire values) ÷ (Number of hires)

Industry averages vary, but a general benchmark is around 25-30 days. However, this can fluctuate depending on the role, location, and market conditions.

Tracking and improving Time to Hire helps reduce recruiting costs, optimize the hiring funnel, and ensure you capture the best candidates before they move on to other opportunities.

Time to Fill vs. Time to Hire: Time to fill measures the total days from job requisition approval to offer acceptance, while time to hire measures the days from a candidate entering the pipeline to accepting the offer.

3. Retention Rate

Retention rate measures the percentage of employees (or customers) who remain with an organization over a specific period.

In an HR context, it reflects the company’s ability to keep its workforce stable by calculating how many employees stayed employed from the beginning to the end of a given timeframe.

The formula for employee retention rate:

Retention Rate = [(Employees at start – Employees who left) ÷ Employees at start] × 100

Retention rate is critical because it impacts organizational stability, costs, productivity, and morale.

High retention generally signals a positive work environment, good leadership, and strong engagement, while low retention highlights potential problems like poor management, lack of career opportunities, or inadequate compensation. Most companies aim for a retention rate of 90% or higher, although healthy turnover for growth and innovation is also important.

Tracking retention helps organizations make strategic decisions around hiring, onboarding, career development, and employee engagement — all aimed at keeping top talent and minimizing turnover.

4. Turnover Rate

Turnover rate tracks the proportion of employees who exit an organization within a defined time frame, most often measured on an annual basis.

It captures both voluntary separations (resignations, retirements) and involuntary separations (layoffs, terminations), but usually excludes internal moves like promotions or transfers.

The formula for turnover rate:

Turnover Rate = (Number of separations ÷ Average number of employees) × 100

This metric is critical because turnover is a leading indicator of organizational health.

High turnover increases recruitment costs, disrupts team cohesion, lowers productivity, and can erode your employer brand. It may signal systemic issues such as:

- Poor management

- Burnout

- Lack of opportunities

- Poor compensation

While turnover varies by industry, many organizations aim for an annual rate between 10-20%.

However, sectors like hospitality and retail see higher figures, while professional services or healthcare may target lower turnover rates.

By analyzing your turnover by department, tenure, or demographics, you can find any underlying problems and start taking steps to improve leadership, engagement, and career development.

5. Sourcing Channel Cost

Sourcing channel cost measures the average amount of money you spend on a sourcing channel like:

- Job boards

- Social media campaigns

- Employee referral programs

- Recruiting agencies

All relative to the number of successful applicants or hires that channel produces.

The formula for sourcing channel cost:

Sourcing Channel Cost = (Total ad spend or fees per channel ÷ Number of successful applicants from that channel)

This metric is important because it connects recruitment marketing investments to actual hiring outcomes.

Understanding sourcing costs helps recruiting teams evaluate the true ROI of each channel, prioritize high-performing sources, and reduce spend on underperforming tactics.

Tracking sourcing channel cost over time, alongside quality-of-hire data, allows teams to optimize their media mix, create accurate forecasts, and build smarter, more cost-effective recruiting strategies that support business growth.

6. Cost Per Hire

Cost per hire (CPH) measures the total average amount an organization spends to recruit and onboard a new employee.

It includes both internal costs (recruiter salaries, hiring manager time, and recruitment software) and external costs (job advertising, agency fees, background checks, and candidate travel expenses).

The formula for CPH is:

CPH = (Internal recruiting costs + External recruiting costs) ÷ Total number of hires

This metric is essential for budgeting, workforce planning, and measuring the efficiency of your hiring process.

A high CPH may indicate over-reliance on expensive sources, inefficient screening methods, or excessive process complexity. A very low CPH might reflect a poor candidate experience or rushed hiring practices that sacrifice quality.

Tracking CPH helps companies balance recruitment investments with talent outcomes.

It enables better decisions about when to invest in new sourcing channels, whether to build versus buy recruiting capability, and how to forecast the true costs of scaling their workforce — without losing sight of candidate quality or organizational fit.

7. Offer Acceptance Rate

Offer acceptance rate reflects the proportion of candidates who agree to a formal job offer out of all offers that have been extended.

It captures how compelling and competitive your job offers are — and by extension, how effective your entire recruitment process has been in engaging and winning over top talent.

The formula for offer acceptance rate is:

Offer Acceptance Rate = (Number of accepted offers ÷ Total number of offers extended) × 100

This metric is important because it impacts both hiring efficiency and employer brand.

A high offer acceptance rate suggests that your compensation, benefits, communication, and overall candidate experience are aligned with candidate expectations. A low acceptance rate signals potential issues, such as uncompetitive offers, poor candidate experience, slow hiring processes, or a weak employer brand.

Across industries, an average offer acceptance rate falls between 80-90%.

High-performing organizations often achieve rates above 90%, particularly when recruiting for business roles. For technical roles, where competition for talent is fierce, lower acceptance rates are common.

Tracking and improving your offer acceptance rate helps reduce recruiting costs, shorten time to hire, and ensure that you don’t lose top candidates late in the process. Key strategies to boost this metric include

- Offering competitive compensation

- Maintaining clear and fast communication

- Personalizing offers

- Improving the candidate experience

- Strengthening your employer brand

Advanced Tracking and Tools

Accurately measuring talent acquisition metrics requires you to have the right infrastructure in place.

To build this, it’s essential to implement tools that automate tracking, centralize data, and provide real-time insights.

Here are some of the tech you can use to track and optimize metrics for talent acquisition:

- Applicant Tracking Systems (ATS): Platforms like Greenhouse, Workday, or SmartRecruiters help manage candidate pipelines, automate reporting, and provide visibility across stages.

- HR Analytics Platforms: Solutions such as iCIMS, Lever, and SmartRecruiters offer deeper talent acquisition metrics and analytics, tracking key performance indicators across sourcing, interviewing, and onboarding.

- Google Analytics: Useful for tracking sourcing data, especially when tied to career sites, landing pages, and job ad performance.

- Survey Tools: Tools like CultureAmp, Qualtrics, or in-house surveys help capture Net Promoter Scores (NPS), candidate satisfaction, and employee engagement metrics post-hire.

Recommended talent acquisition metric dashboards to monitor performance:

- Funnel Conversion by Stage: Analyze drop-off points at every step of the hiring funnel.

- Monthly Recruiter KPIs: Track recruiter performance based on hires made, time to hire, and offer acceptance.

- Real-Time Source Performance: Measure which sourcing channels are producing the highest quality candidates and best ROI.

- Diversity Trends by Hiring Stage: Monitor demographic representation and movement through each stage of the funnel to ensure equitable hiring practices.

Using integrated systems and dashboards improves your recruiting function — supporting smarter decision-making and continuous optimization.

How to Prioritize Talent Acquisition Metrics

Selecting which metrics to prioritize should be guided by your company’s current objectives and broader strategic goals.

Start by defining your primary hiring objective:

- Speed and Volume: Focus on time to hire and time to fill to accelerate growth without sacrificing candidate quality.

- Cost Control: Prioritize CPH and sourcing channel cost to maximize budget efficiency and reduce unnecessary spending.

- Retention and Culture: Emphasize retention rate, turnover rate, and offer acceptance rate to strengthen your workforce and minimize turnover.

Once you’ve identified what matters most, then set a clear standard to measure progress, and track how you’re improving over time:

- Internal Baselines: Use historical data from the past 6-12 months to establish a baseline.

- Industry Averages: Compare against sector benchmarks to understand how your metrics stack up.

- Strategic OKRs: Tie your talent acquisition metrics to broader company OKRs to ensure alignment with business growth and performance goals.

By prioritizing your metrics and benchmarking progress, you’ll ensure your talent acquisition efforts stay agile, strategic, and connected to overall business success.

Ready to Build a Data-Driven Hiring Engine?

When you’re scaling a startup, instinct isn’t enough — you need clear, actionable metrics to steer your hiring strategy toward sustainable growth.

Tracking the right talent acquisition metrics transforms recruiting from a tactical task into a strategic advantage:

- Boosting your hiring speed

- Cutting costs

- Elevating candidate quality

- Future-proofing your employer brand

But metrics alone won’t build your dream team. You need the right partner to help you design a system that fits your goals, culture, and growth stage.

That’s where TalentHub can help.

TalentHub specializes in helping startups and scaling companies build customized, data-driven talent acquisition strategies that deliver real results. Whether you need help fine-tuning your hiring funnel, optimizing your sourcing channels, or strengthening your employer brand, their team of experts is ready to partner with you.